Shelter Places: Ultimate online casino golden goddess Guide to possess Renters 2025 Roost

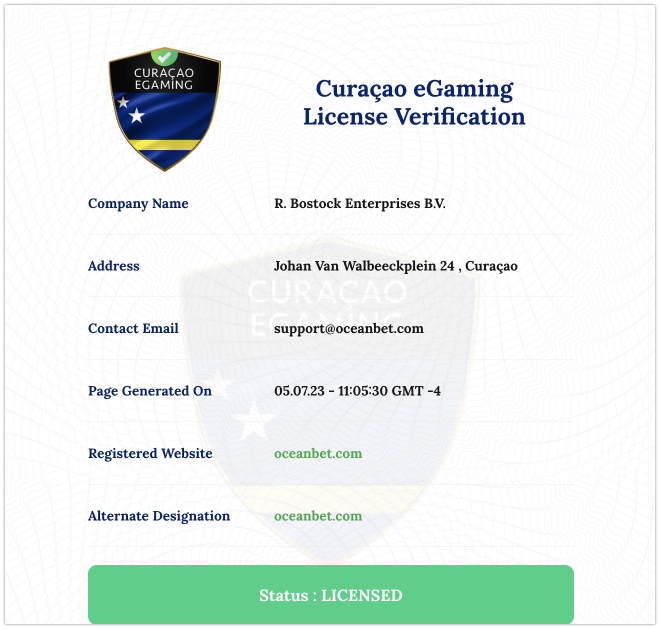

Most web based casinos features the very least deposit out of both $10 otherwise $20, that is nevertheless a great restrict, even although you’lso are on a tight budget. All these workers offer great bonuses, very feel free to speak about her or him thru all of our system. Offered a good 5 money lowest put gambling establishment Canada offer professionals, online casino labels acknowledge the fresh perks’ importance so you can spur users to join up and you will put. Such advantages, including the welcome put bonus and you may related also offers, can be somewhat impression professionals’ effect. Our very own assessment away from on line real cash casinos prioritizes licensing, since it’s a critical signal of an internet site .’s authenticity and you will reliability. I come across casinos which might be relative to Canadian legislation and you can are accountable to the correct regulating authorities for every region.

Available to owners out of online casino golden goddess AL, AR, Florida, GA, IL, Within the, IA, KY, La, MS, MO, NC, South carolina, TN, and you will Colorado. Offered to citizens away from NH, MA, RI, CT, DE, Ny, Nj, PA, or Florida. Designed for residents from IA, IL, Inside, KS, MI, MN, MO, OH otherwise WI. See the charge on every of these accounts because they usually vary.

There are numerous the brand new answers to the protection deposit condition—specific had been lauded from the affordable homes advocates, while others was met with skepticism and you will mistrust—often for good reasons. Everything’ll need to watch out for would be the monthly low-refundable fee you could find yourself investing. These costs merely go on the helping the possessions shell out the insurance and you also nevertheless can be charged cash on disperse-away the damages.

You can prove that you provides a closer connection to two foreign places (however over two) for those who see all following the criteria. An expert runner that is briefly in america in order to compete in the a non-profit football knowledge try an excused private. An altruistic activities experience is but one that suits the following requirements. You would not be an exempt personal while the an instructor or trainee inside 2024 if perhaps you were exempt since the an instructor, trainee, otherwise scholar for element of dos of one’s 6 preceding schedule ages. However, you are an excused personal if the following standards are met.

Online casino golden goddess | Range step 1 – Desire money

Given the San francisco bay area’s notoriously air-highest houses will set you back, as well as the area’s homelessness crisis, it’s unsurprising your requirement for advice about places regarding the city much outstrips the supply. The newest Housing Believe from Silicone polymer Area, a san francisco community advancement lender, has a grant program particularly for permitting anyone sense homelessness within the the bedroom afford security places. The newest Finally House Deposit System is funded because of the Used Material Silicone Valley Turkey Trot, an annual 5K you to definitely brings specific ten,100 so you can 15,100000 runners. Property Trust spends the portion of the fund so you can honor one to-date gives as much as $2,five hundred from the deposit program to help individuals hop out homelessness from the level upfront swinging will set you back. And though places are by definition refundable, there’s no make certain clients becomes those funds back, whether or not it shell out the book and you can eliminate the unit really.

That it simply has transport income that is handled because the produced by provide in america in case your transport initiate or closes in the usa. For transport earnings away from personal features, the brand new transport have to be between your All of us and you will a good U.S. area. Private services out of a good nonresident alien, so it only relates to income produced from, or even in contact with, an aircraft. Yet not, if there’s an immediate economic dating between your carrying away from the brand new advantage as well as your change otherwise business of accomplishing individual services, the amount of money, get, or losings try effectively linked.

Figuring The Income tax

When you are a member of staff and also you found wages susceptible to You.S. income tax withholding, might fundamentally document by the fifteenth day of the newest 4th week after the tax season ends. To your 2024 season, document the get back by April 15, 2025. You ought to file Function 1040-NR while you are a dual-reputation taxpayer who offers up household in the us throughout the the season and you may who’s not a U.S. resident for the last day’s the newest income tax seasons.

- While you are a citizen of Mexico or Canada, or a national of the Us, you could potentially claim all of your dependents which matches certain examination.

- The choice to become treated since the a citizen alien is actually suspended for the income tax year (following the taxation 12 months you made the possibility) when the none spouse are a You.S. resident otherwise resident alien when inside tax year.

- If you be eligible for so it election, you can make it from the filing a type 1040 and you may tying a signed election statement on the go back.

- This guide stops working common issues renters deal with and demonstrates to you just how some other county laws and regulations protect renters as you.

- You ought to document Setting 8938 if your full property value those people possessions exceeds an applicable threshold (the fresh “revealing threshold”).

What’s more, it has a good 35x bet standards, making it simpler to possess professionals to fulfill the new requirements and you will bucks-aside the earnings rather problems. The fresh Harbors Gambling enterprise welcomes The brand new Zealand participants that have an tremendous added bonus plan up to NZ$the initial step,five hundred in just a good NZ$5 deposit. In case your financing development and dividends are efficiently linked to an excellent U.S. change or organization, he is taxed with respect to the exact same laws and also at the brand new exact same prices one apply at U.S. residents and you will people. When you are a U.S. citizen otherwise citizen and you also want to lose the nonresident mate because the a resident and document a combined income tax return, your nonresident partner needs an enthusiastic SSN or a keen ITIN. Alien spouses that advertised while the dependents are also needed to furnish an SSN otherwise ITIN. If you’re not a member of staff whom obtains wages susceptible to U.S. tax withholding, you must file by the fifteenth day of the new 6th few days after your own income tax 12 months finishes.

When the a property manager doesn’t pay the citizen focus, they’re fined as much as $100 for each and every crime. But not, possessions managers don’t need to pay citizens interest for few days if the resident are 10 or maybe more months later investing book and you may wasn’t recharged a later part of the fee. While the a property manager inside Connecticut, becoming well-advised about the latest defense deposit legislation isn’t merely sound practice—it’s a foundation of your business’s credibility and you can legal compliance.

U.S. Bank account for Canadians

Some states allow it to be landlords to charges far more, however, regional characteristics’ industry rate usually exists. If you are element of a HUD local rental guidance program, the defense deposit is generally as little as $fifty. For most, taking protection deposits right back isn’t just a great “sweet topic” to happen otherwise some “fun currency.” It’s money must let shelter moving costs. Of many clients get upset when trying to get their deposit right back. If the certain types of write-offs, exclusions, and you can loans try claimed, the new property or trust may be subject to Ca’s AMT. Score Agenda P (541) to work the amount of taxation to go into online 26 to own trusts with possibly citizen or non-citizen trustees and you may beneficiaries.

Publication 519 – Extra Issue

As a result there won’t be any withholding out of social security or Medicare taxation on the spend you get of these functions. These types of services are extremely limited and usually is only on-university functions, standard education, and you can monetary difficulty a job. A shipment by the a QIE to help you a good nonresident alien shareholder you to is managed as the gain from the sale or exchange out of a great You.S. real-estate desire from the shareholder are subject to withholding at the 21%. Withholding is additionally expected on the certain distributions and other transactions by the residential otherwise overseas businesses, partnerships, trusts, and estates. If you are a nonresident alien performer otherwise athlete doing otherwise doing sports events in the usa, you might be in a position to get into a good CWA to your Irs for smaller withholding, offered certain requirements is actually met.

Certain foreign-source investment money such as desire and you can financing progress can be subject to tax. For additional info on Paraguay’s corporate income tax, courtroom framework and you may tax treaties, here are some incorporations.io/paraguay.This will never be construed as the income tax information. I have usage of a worldwide network away from licensed attorneys and you may accounting firms that will supply the right advice about your specific points. When there is no worker-workplace relationship anywhere between you and anyone for the person you manage functions, the payment is susceptible to the brand new 30% (otherwise down pact) speed away from withholding. A contract that you arrive at for the Internal revenue service out of withholding of the payment to own independent individual characteristics works well to have money safeguarded by the contract just after it’s wanted to by the events. You must commit to prompt document an income tax come back for the present day tax seasons.

Personal protection and you can Medicare taxation are not withheld out of pay money for it works until the newest alien is known as a citizen alien. If you are an excellent nonresident alien briefly admitted on the United Says while the students, you’re fundamentally not permitted to work for a wage or income or perhaps to take part in company when you’re in the United states. Occasionally, a student admitted to the All of us within the “F-1,” “M-1,” otherwise “J-1” reputation are granted permission to function.